property tax rates philadelphia suburbs

06317 City 07681 School. The average effective property tax rate in Philadelphia County is 098.

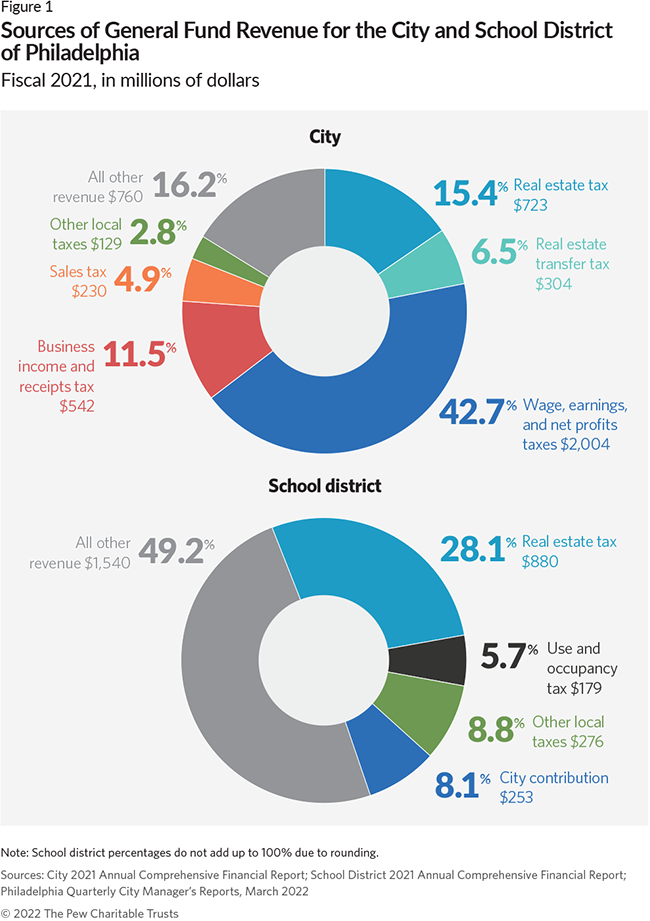

The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City.

. Get help with deed or mortgage fraud. For the 2022 tax year the rates are. Property tax rates philadelphia suburbs Wednesday June 8 2022 Edit.

In relation to the 100 wealthiest towns Philadelphia. Milwaukee Wisconsin and Milwaukee County. Get home improvement help.

It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation. Request a circular-free property decal. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Get help paying your utility bills. Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by. The countys average effective property tax rate is 212.

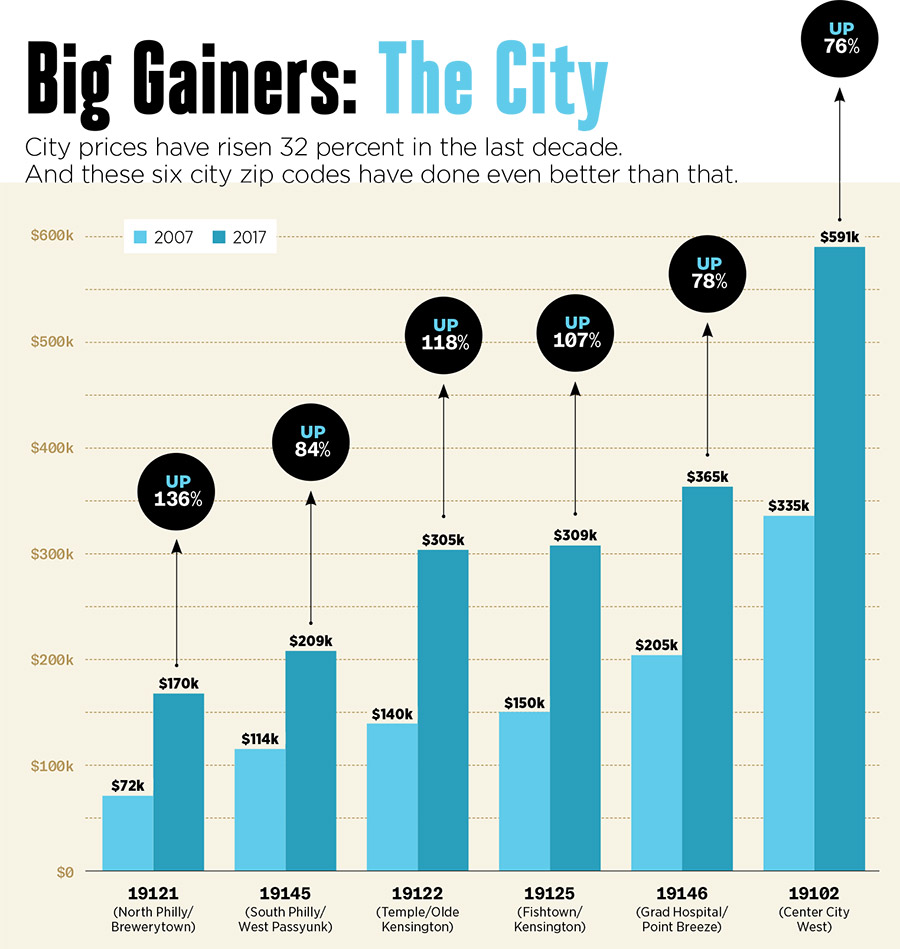

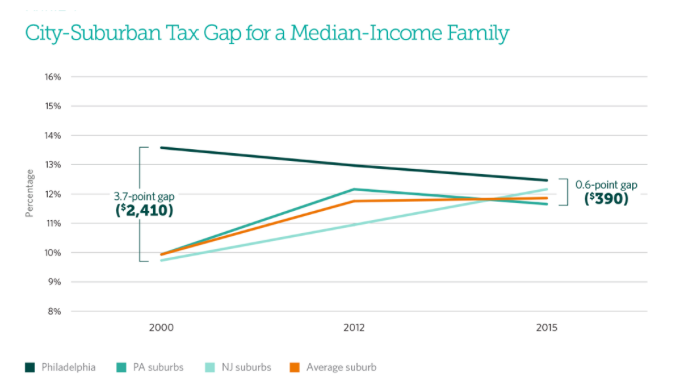

Get a property tax abatement. Milford Square is a great place to live. Tax bills in the suburbs falling income tax rates in Philadelphia and lower property assessments relative to home values in Philadelphia during the period.

Philadelphia County is located in Pennsylvania. The average effective property tax rate in Philadelphia County is 098. Milford Square is a great place to live.

It is close enough to all local stores safe community and a great place to raise. Now consider you live in the suburbs but also work in a Philadelphia suburb. 2 days agoOct 20 2022.

Tax amount varies by county. Buy sell or rent a property. And now his home in suburban Philadelphia the.

Mehmet Oz barely goes a day on the campaign trail without someone questioning his ties to Pennsylvania. According to a more. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

It is close enough to all local stores safe community and a great place to raise your children. Philadelphia County collects on average 091 of a propertys. The gap between the average.

That rate applied to a home worth 239600 the county median would result in an annual property tax. 135 of home value. Derek Green S Land Value Tax.

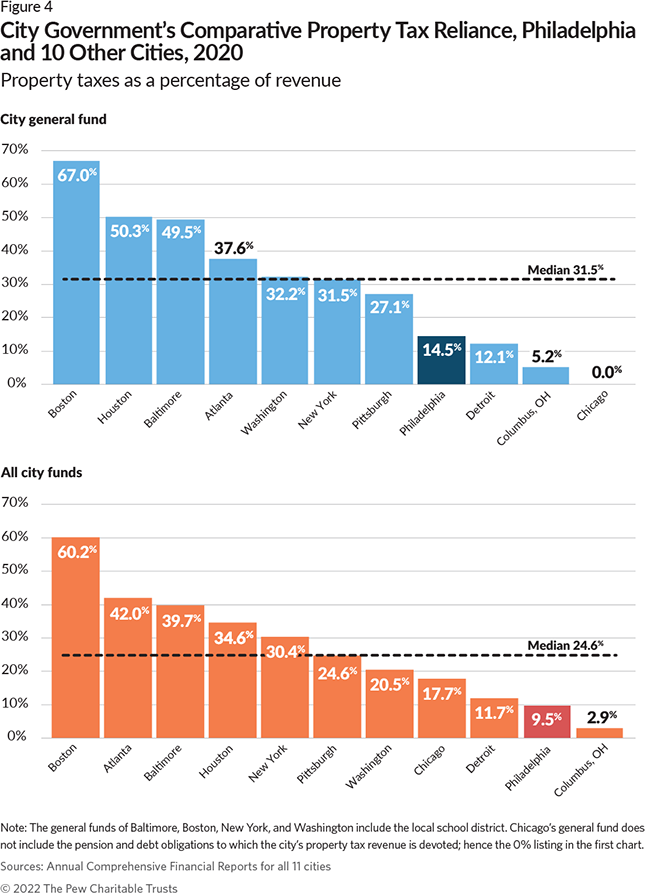

Property taxes are the cornerstone of local community budgets. Pennsylvania is ranked 1120th of the 3143 counties in the United. It has the highest median property tax rate in the Midwest besides Chicago at 276.

Detroit Michigan is a part of Wayne County. Among the 100 poorest communities in the area Philadelphias tax burden declined from third-heaviest in 2000 to 59th-heaviest in 2015. While the Philadelphia Wage Tax may be 2-4 times higher than the suburbs Philadelphias real estate taxes are.

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Find Your Philly Dream House At Last

15 Hottest Towns In Philadelphia S Western Suburbs

Pennsylvania Property Tax Calculator Smartasset

Why Are Residential Property Tax Rates Regressive

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America

15 Hottest Towns In Philadelphia S Western Suburbs

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

City Skeptical Of Recent Data For Philadelphia Property Taxes

Pew Tax Gap Shrinking Between Philadelphia And Suburbs Phillyvoice

Philadelphia Rent Jumped 6 During The Pandemic Suburbs Up 12 To 15 On Top Of Philly News

Citywide Reassessment Philadelphia Forward

Sra Suburban Realtors Alliance School Funding In Pennsylvania

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

How Parasites Poison Nyc Suburbs Property Tax System

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Pennsylvania Property Tax H R Block

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia